Introduction:

Running a small business comes with a lot of responsibilities, and managing finances is one of the most important. Whether you are a shop owner, a freelancer, or running a small startup, keeping your personal and business finances separate is crucial for smooth operations. This is where a current account becomes a must-have tool.

A current account is a specialized bank account designed for businesses to handle daily financial transactions. Unlike savings accounts, which are meant for personal use and have transaction limits, a current account allows businesses to make unlimited deposits and withdrawals, making it perfect for handling business operations. It also offers additional features like overdraft facilities, multi-city cheques, and tailored services to suit the needs of growing businesses.

Having a current account not only makes your transactions easier but also adds professionalism to your business. When you make payments or receive funds through a current account, it creates trust with customers and suppliers, as it shows your business is well-organized and credible.

For small businesses in India, opening a current account is not just a choice—it’s a step towards better financial management and growth. In this guide, we will take you through the simple process of opening a current account, the benefits it offers, and how to choose the right one for your business. Whether you are new to banking or looking to switch to a better option, this guide will help you make informed decisions.

Let’s get started!

What is a Current Account?

A current account is a type of bank account specially designed for businesses, traders, and entrepreneurs to manage their financial transactions efficiently. It is different from a savings account as it is meant for daily business activities and not for saving money.

Here are the key features of a current account:

1. Unlimited Transactions

A current account allows businesses to make an unlimited number of deposits and withdrawals. There are no restrictions on the volume or frequency of transactions, making it ideal for managing daily business operations.

2. No Interest Earned

Unlike a savings account, a current account does not earn interest on the balance. The focus of a current account is to provide flexibility and ease of transactions rather than savings.

3. Overdraft Facility

Many banks offer an overdraft facility with current accounts. This means you can withdraw more money than your account balance in case of an emergency or cash shortage.

4. Professional Transactions

Payments made through a current account, such as cheques, demand drafts, or online transfers, add professionalism and trustworthiness to your business dealings.

5. Business-Specific Services

Current accounts often come with additional features like:

- Multi-city cheque facilities

- Bulk payment options (for salaries or supplier payments)

- Customized statements to track transactions

6. High Cash Handling Limits

For businesses that handle a lot of cash, a current account is beneficial because it allows high cash deposits and withdrawals without additional charges.

Who Needs a Current Account?

A current account is suitable for:

- Small businesses

- Shopkeepers and traders

- Startups

- Freelancers and professionals like consultants or lawyers

- Companies and partnerships

Why is a Current Account Important for Businesses?

A current account is not just a bank account—it’s a tool that helps businesses:

- Keep personal and business finances separate.

- Build trust and credibility with customers and suppliers.

- Easily manage cash flow and daily transactions.

Access additional banking features like overdraft facilities, bulk payments, and multi-city cheques.

Whether you’re running a small business from home or managing a growing enterprise, a current account is essential for efficient money management and smoother operations.

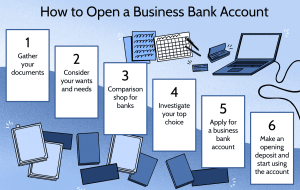

Steps to Open a Current Account for Your Small Business

Opening a current account for your small business in India is a straightforward process. Follow these simple steps to get started:

Step 1: Research and Choose the Right Bank

Look for banks that offer current accounts suitable for small businesses.

Compare features like:

Minimum balance requirement.

Banking fees and transaction charges.

Online and mobile banking facilities.

Additional benefits like overdraft services or free cheque books.

Examples of banks: HDFC Bank, ICICI Bank, State Bank of India (SBI), Axis Bank, Kotak Mahindra Bank.

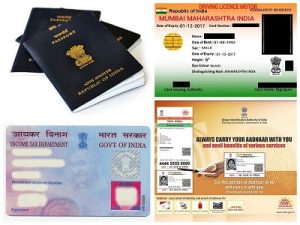

Step 2: Gather the Required Documents

You need to provide specific documents to open a current account.

For Sole Proprietorships (Owned by One Person):

- PAN Card (your unique tax identification number).

- Proof of identity (Aadhaar, Passport, Voter ID, or Driving License).

- Proof of address (such as utility bills or rental agreements).

Business proof, such as:

- GST Registration Certificate (if applicable).

- Shop and Establishment Act License.

- For Partnerships (Owned by Multiple People):

- PAN Card of the partnership firm.

- Partnership deed (agreement between the partners).

- Identity and address proof of all partners.

- Business registration certificate (if registered).

- For Private Limited Companies:

- Certificate of Incorporation.

- Memorandum of Association (MoA) and Articles of Association (AoA).

- PAN Card of the company.

- Board resolution authorizing the account opening.

- Address proof of the company and directors.

Step 3: Visit the Bank or Apply Online

Offline Process: Go to the bank branch and ask for the current account opening form. Fill out the form and submit it with your documents.

Online Process: Many banks now allow you to apply online. Visit the bank’s website, upload scanned copies of the required documents, and follow the instructions.

Step 4: Choose the Right Current Account Type

Banks offer different types of current accounts based on your business needs.

Basic Current Account: Suitable for businesses with limited transactions.

Premium Current Account: Includes higher cash deposit limits and value-added services like bulk payments or free cheque books.

Ask the bank staff for guidance in choosing the best account for your business.

Step 5: Complete KYC Verification

The bank will verify your documents under the Know Your Customer (KYC) process. This ensures all the information you provide is accurate.

Step 6: Deposit the Minimum Balance

Most banks require you to deposit a minimum amount to activate your account.

Some banks also offer zero-balance current accounts for small businesses.

Step 7: Activate Your Current Account

Once the bank verifies your documents and processes your application:

Your account will be activated.

You will receive your account details, cheque book, debit card, and access to online banking.

Tips to Make the Process Easier

Opening a current account for your small business can seem overwhelming at first. However, by planning ahead and keeping a few practical tips in mind, you can simplify the process and save time. Here are some useful tips to make opening a current account easier:

1. Research Banks Thoroughly

Not all banks offer the same benefits or terms for current accounts. Spend some time comparing different banks to find the one that suits your business needs best.

Look for banks with low minimum balance requirements if you’re just starting out.

Check if the bank offers perks like free demand drafts, business debit cards, or low transaction charges.

Ensure the bank has a strong digital presence, as online banking can save you time and effort.

2. Keep Your Documents Ready

One of the most common reasons for delays is incomplete or incorrect documentation. Ensure that all required documents are:

- Up-to-date and valid.

- Properly signed by authorized persons (if applicable).

- Well-organized in a folder for easy access during submission.

Pro tip: Keep extra photocopies of all documents and their originals handy during the application process.

3. Consider Online Applications

Many banks now allow you to apply for a current account online. This is especially helpful if you have a busy schedule or if the bank branch is far from your location.

Online applications are faster and require minimal paperwork.

Some banks even offer doorstep verification services for added convenience.

4. Verify Business Eligibility

Each type of business structure (proprietorship, partnership, private limited company, etc.) has different eligibility criteria and document requirements. Ensure you understand what is needed for your specific business type to avoid confusion.

5. Start with Your Existing Bank

If you already have a savings account with a bank, consider opening your current account there.

Existing relationships with a bank often make the process smoother, as they already have some of your details on file.

You may also be eligible for loyalty benefits, such as reduced fees or faster processing.

6. Ask for Help from Bank Representatives

Bank officials are there to guide you through the process. Don’t hesitate to:

- Ask questions about specific account features.

- Request assistance in filling out forms.

- Seek clarification on transaction limits, fees, or benefits.

7. Stay Organized

The process can involve multiple steps, including filling forms, verifying documents, and making deposits. To stay on track:

- Create a checklist of the steps and mark them off as you complete them.

- Note deadlines, such as when the initial deposit must be made.

- Follow up with the bank if there are delays in account activation.

8. Opt for Banks with Business-Focused Features

Some banks offer specialized accounts for small businesses, which include features like:

- Bulk transaction handling.

- Integration with accounting software.

- Free inward remittances or digital tools for GST payments.

- Choosing such accounts can simplify your financial operations significantly.

9. Maintain Open Communication

Be responsive to the bank’s calls or emails. If additional information or documents are required, provide them promptly. This will prevent unnecessary delays.

10. Take Advantage of Add-On Services

Banks often offer additional services that can benefit your business, such as:

- Credit or overdraft facilities to manage cash flow.

- POS machines for accepting card payments.

- Mobile apps for 24/7 access to your account.

Explore these options to get the most out of your current account.

Conclusion

A current account is a vital tool for managing your small business’s finances efficiently. By choosing the right bank, gathering the necessary documents, and following a clear process, you can open a current account with ease and professionalism. Additionally, to truly empower your business, consider leveraging digital solutions like OrderZ e-commerce website builder.

With OrderZ, you can create an online store quickly, manage your sales seamlessly, and integrate with various payment systems, making it easier to handle transactions from your current account. By combining a strong banking foundation with smart e-commerce tools, you can ensure your business thrives in both the physical and digital marketplaces. Start building your success today!